Total Shares Short vs. Short Ratio vs. Short Interest

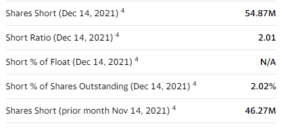

Total Shares Short

This should be obvious. Total number of shares that have been shorted. This number is never exact – and is only reported every 15 days.

Short Ratio

Is just the ratio of total shares shorted to total float

Short Interest

Looks at options data. Put/ Call ratio specifically. If the puts are higher than the calls, this ratio can exceed 1. For me, a 0.5 Put / Call ratio signals bearish sentiment (half the public believes this stock will go down)

Yahoo Finance –> Statistics Tab

e.g. BABA Short Ratio is shown in Yahoo Statistics below

Leave a Reply